Carriers have lost their ‘cloaks of invincibility’, says Steve Endacott

The UK travel industry needs a healthy airline sector to operate, so I was pleased to see that easyJet, British Airways and, hopefully soon, Virgin Atlantic have secured extra funding and look relatively safe so long as the flying lockdown does not stretch further than six months.

David Speakman, founder of Travel Counsellors, has been highly critical of the airlines and widely quoted describing them as “operating a Ponzi scheme” where they demand full payment from customers on booking and then use customer cash as they see fit.

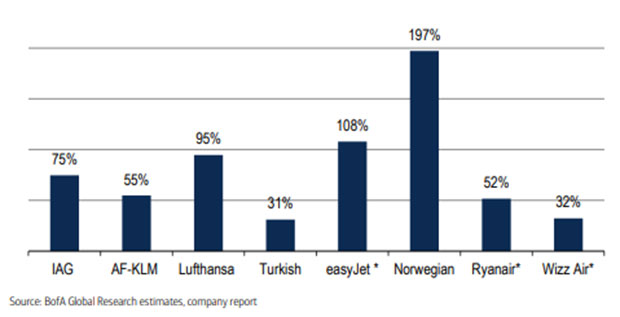

Recent research by Bank of America seems to support this view. The bank looked at the amount of money each airline banked from un-flown flights (much of which will need to be refunded) as a percentage of how much cash it had in the bank.

As you can see from the accompanying chart, a few airlines like Ryanair had enough cash to afford refunds – irrespective of how easy they have made getting these – but many did not.

I appreciate airlines need cash up front to buy or lease capital-intensive assets like aircraft and customers benefit from this in the form of efficient new aircraft and lower prices.

Most airlines have been able to raise substantial funds to prevent collapse, showing robustness in their models – although David Speakman may rightly argue that these loans have been secured on the basis of airlines being able to access billions in unprotected consumer cash as soon as they start flying again.

So should airlines be forced to follow online travel agents and retailers in adopting trust fund models?

In that case, a customer’s cash would only be released to airlines once the customer has flown.

I’m sure airlines would argue these measures would be “draconian” given their capital intensive nature and the current financial pressure they are under.

But if agents and hoteliers aren’t allowed to use customer cash as interest-free loans why are airlines? Why should airlines be allowed use customer money before they provide the service contracted?

Ironically, in the short term the airlines’ credit card clearers are enforcing ‘quasi’ trust funds by holding on to billions of airlines’ cash as protection against the high level of credit-card recharges they are expecting on cancelled flights. So the hit on cash flow may not be as large as people think.

Ultimately, I’m in no doubt the right thing would be to force airlines to protect customers cash 100% with trust funds, but I accept this may take a number of years to deliver.

In the short term, the priority needs to be getting UK airlines flying again so they are able to deliver deferred flights or refund customers. I would not want anything that risks this.

However, in the post-corona environment regulators must accept airlines are riskier and at least level the bonding playing field.

Many airlines will have debt mountains to pay down and if they don’t operate trust fund protection they will represent a much bigger risk than trust fund operating OTAs like On the Beach and travel companies and networks such as Travel Counsellors and Trailfinders.

It is ridiculous for airlines to remain unbonded and Atol fee-free while lower-risk businesses are required to fund the replenishment of the Atol fund, which is needed as the ultimate guarantor of consumers’ money.

It is also beyond ridiculous that when the next airline fails the government will repatriate all UK citizens whether they have paid fees for repatriation or not.

It is time the CAA finally implemented its stated desire for an ‘all seats levy”.

This could be collected across all flights leaving the UK whether a customer has DIY booked a holiday via Google, using low-cost carrier sites and un-bonded bed banks like Booking.com, or has brought the same package via an OTA, homeworker or high street travel agent.

The current Atol fund is virtually empty after the Thomas Cook collapse and will be further hit via travel collapses in the next six months.

It is likely the current £2.50 per passenger fee will have to double to £5.00, but at least it will replenish much quicker if airlines also have to pay.

In the longer term, the CAA should enforce trust funds across the board or charge a hefty premium to the standard Atol fee for any company refusing to implement this basic level of protection for customer funds.

I wish all UK airlines a successful rebound, but if coronavirus has done anything it has removed their false ‘cloak of invincibility. They need to be brought into the consumer protection fold.